Key Takeaways:

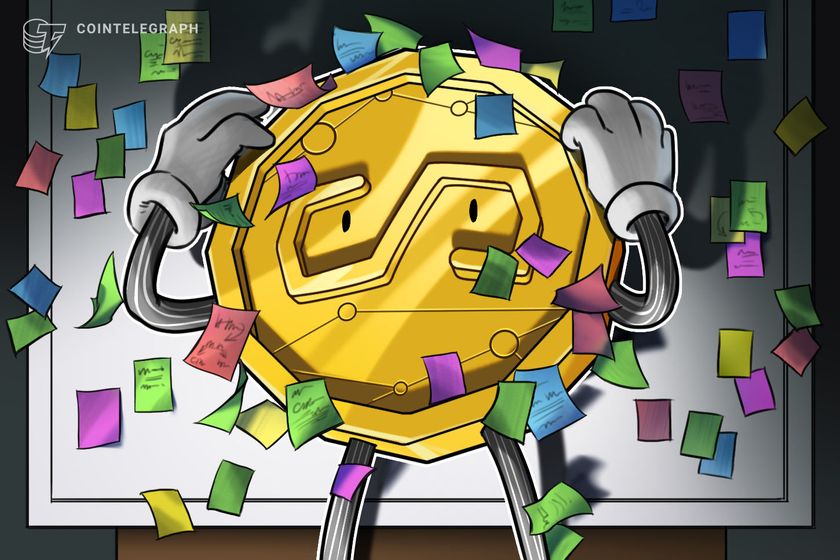

Dogecoin's active addresses surged 528% to 469,477.

DOGE’s futures open interest rose 70% to $1.65 billion, indicating strong speculative interest.

On May 13, Dogecoin (DOGE) witnessed a staggering 528% increase in active addresses, soaring from 74,640 to 469,477, signaling robust network activity and growing investor interest. This surge followed an update to 21Shares’ filing for a spot Dogecoin ETF, receiving acknowledgement from the US Securities and Exchange Commission (SEC). The financial services firm confirmed the development on X on May 14.

Dogecoin active addresses. Source: GlassnodeThe filing, which aims to track DOGE’s price, aligns with similar efforts by Bitwise and Grayscale, hinting at potential mainstream adoption. This news fueled market optimism, leading to a rise in the memecoin’s network activity.