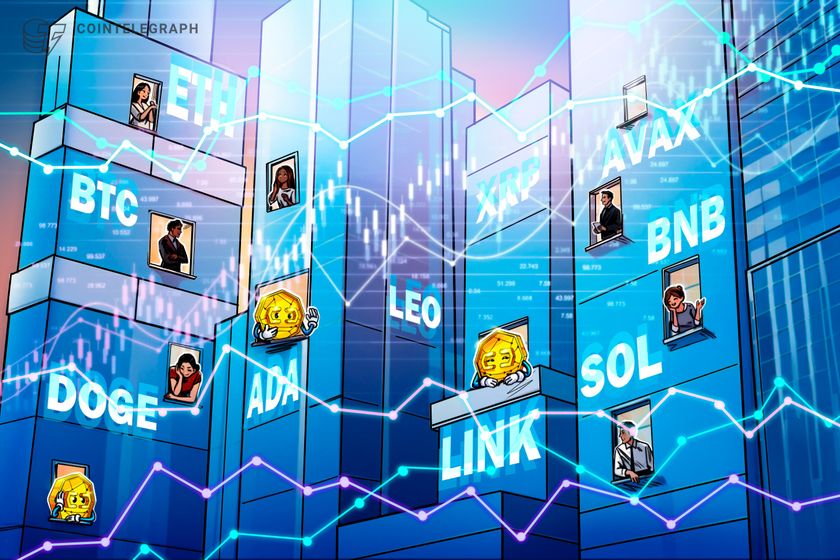

Bitcoin (BTC) remains under pressure as macroeconomic uncertainty continues to weigh on its price action. After making a strong bounce from the local bottom near $75,000 on April 7 and 9, analysts are beginning to question whether BTC could be gearing up for a reversal of the downward trend that’s persisted since the start of the year.BTC/USD 1-day, RSI 1-week. Source: Marie Poteriaieva, TradingView

For some, like the veteran trader Peter Brandt, this trendline is nothing but hopium. As he noted in his X post,

“Of all chart construction, trendlines are the LEAST significant. A trendline violation does NOT signify a transition of the BTC trend. Sorry.”Others, however, see more reason for cautious optimism. Analyst Kevin Svenson highlighted a possible weekly RSI breakout, pointing out that “Once confirmed, weekly RSI breakout signals have proven to be among the most reliable macro breakout indicators.”

Ultimately, price is driven by supply and demand—and while both sides of the equation are beginning to show subtle signs of recovery, they are yet to reach the levels needed for a proper breakout. Furthermore, the bulls must cut through a dense sell wall near $86,000 to confirm the reversal.

Bitcoin demand — Are there early signs of recovery?

According to CryptoQuant, Bitcoin’s apparent demand — measured by the 30-day net difference between exchange inflows and outflows — is showing early signs of recovery after a sustained dip into negative territory.